It might feel like the end of the world is close if you see what is happening onchain. I could even argue that AI has replaced crypto as the hotbed for what is next. There is an element of truth to all of it, but it helps to zoom out. Saurabh’s piece today does just that.

He explains how innovation cycles evolve progressively to reach a point in time where technologies find market fit. Today’s story digs into what is common between Uber, Pendle and EigenLayer. Hopefully it serves as perspective through the gloom and doom on your Twitter feeds.

Also, several of our portfolio companies are in the middle of a hiring spree. If you are looking for a change in role, consider dropping in your details here. On to the story now,

Joel

Hello!

The real magic of technology is rarely in the initial invention; it’s in the ecosystem that grows around it. Think of it as compounding, but for innovation instead of money.

While first movers who create new primitives grab headlines and VC dollars, it’s often the second wave of builders who extract the greatest value— the ones who spot untapped potential in existing foundations. They see possibilities that weren’t obvious to others. History is filled with examples of innovators who never predicted how their creations would reshape the world. They were just trying to solve immediate problems. In doing so, they unlocked possibilities far beyond their original vision.

The best innovations aren’t endpoints. They’re launchpads that let entirely new ecosystems take flight. Today’s article explores how this phenomenon plays out in Web3. We start with a tool you use every day. The GPS. Then trace our way back to crypto through re-staking and points.

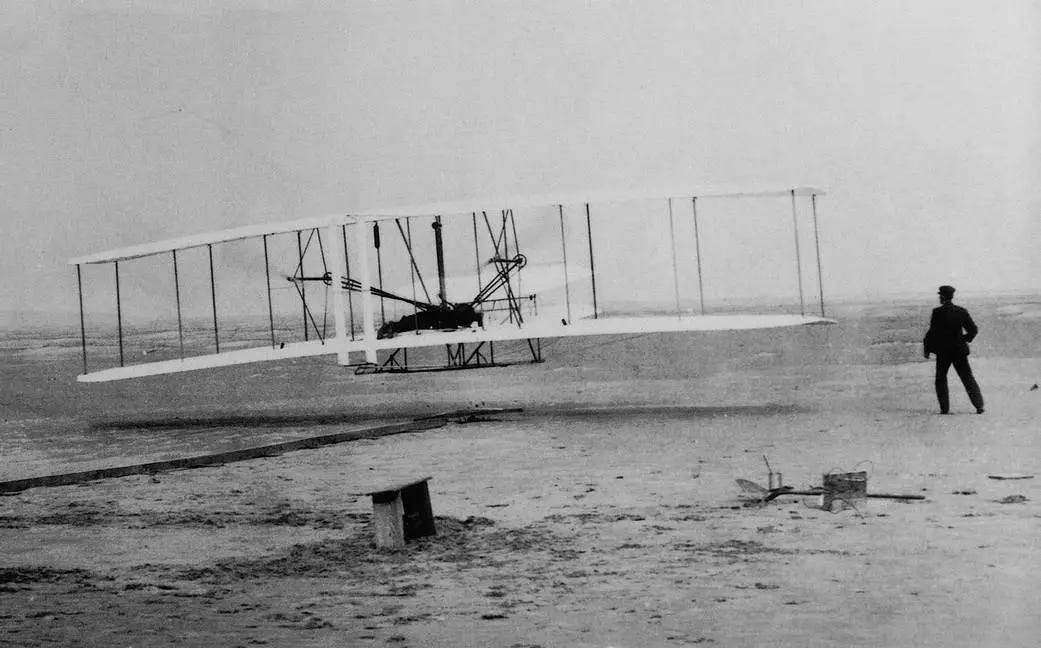

A weekend that changed the Web

The Global Positioning System (GPS) has existed since 1973, telling us exactly where we are on Earth. But Google Maps goes way beyond that by making that raw data accessible, useful, and meaningful to billions of people.

Google Maps began with three strategic acquisitions in late 2004.

First was Where 2 Technologies, a small Australian startup working from a Sydney bedroom. They had developed “Expedition”, a C++ desktop application using pre-rendered map tiles for smooth navigation. It provided a vastly superior UX to MapQuest’s clunky experience.

Simultaneously, Google acquired Keyhole (satellite imagery technology) and ZipDash (real-time traffic analysis), assembling the core pieces of its mapping vision. Together, these formed the foundation of what would be Google Maps: a blend of interactive navigation, rich visual data, and dynamic information packaged into a singular application.

Expedition was a desktop app, but Larry Page had insisted on a web-based solution. The first attempts were sluggish and uninspiring. Bret Taylor, a Stanford graduate who was an Associate Product Manager at Google began working on fixing it up.

Taylor rewrote the entire front-end, leveraging Asynchronous JavaScript and XML (AJAX). It was an emerging technique that allowed websites to update content without reloading entire pages. Before AJAX, web applications were static and clunky. But with AJAX, they could be as responsive as desktop software. Maps became draggable, with new tiles loading without page refreshes—a revolutionary user experience in 2005.

The true genius was when Google released the Maps API later that year, transforming it from a product to a platform. Developers could now embed and build upon Google Maps, sparking thousands of “mashups” that eventually became entire businesses. Uber, Airbnb, and DoorDash all exist because Taylor made maps programmable during one determined weekend.

What Taylor intuited was something that plays out repeatedly in technology: the most profound value often emerges not from foundations, but from what others build on top of them. These “second-order effects” represent the true compounding magic of innovation—when one breakthrough enables an entire ecosystem of unexpected applications.

Once Google Maps became programmable, it set off a chain reaction. Airbnb, DoorDash, Uber, and Zomato were some of the first to hop on, weaving GPS into the core of their services. Pokémon Go took it even further, layering augmented reality on top of location data to blur the lines between the real and virtual.

And behind all of this? Payments, of course. Because what good is an on-demand service if you can’t seamlessly pay for it?

The GPS tech they all relied on wasn’t new. But GPS alone didn’t make the magic. It was the culmination of decades of technological evolution, such as satellite positioning, mobile hardware, AJAX, APIs, and payment rails, all snapping into place.

That’s what makes second-order effects so powerful. They’re rarely loud or flashy in the moment. But one day you look up, and realise your daily errands are being coordinated by an invisible network of innovations that quietly stacked up over the years.

How Restaking Birthed Products

When EigenLayer brought “restaking” to the Ethereum mainnet in June 2023, it altered the Ethereum security landscape. The concept was novel yet simple enough that any crypto-curious person could grasp it: “What if you could stake your ETH twice?”

Let me explain. In traditional staking, your ETH earns a steady but modest 3.5-7% yield. Restaking essentially allows that same ETH to work double-duty, securing the Ethereum network while simultaneously securing EigenLayer’s protocol network—same capital, multiple revenue streams, improved capital efficiency.

By April 2024, EigenLayer had transformed from a theoretical innovation to a fully operational system with remarkable adoption. The numbers tell the story. 70% of new Ethereum validators opted to join the protocol immediately. By late 2024, over 6.25 million ETH, or ~$19.3 billion, was locked in restaking. For context, it would be ranked somewhere in the 120s on the list of countries by highest GDP, now working overtime in DeFi’s digital economy.

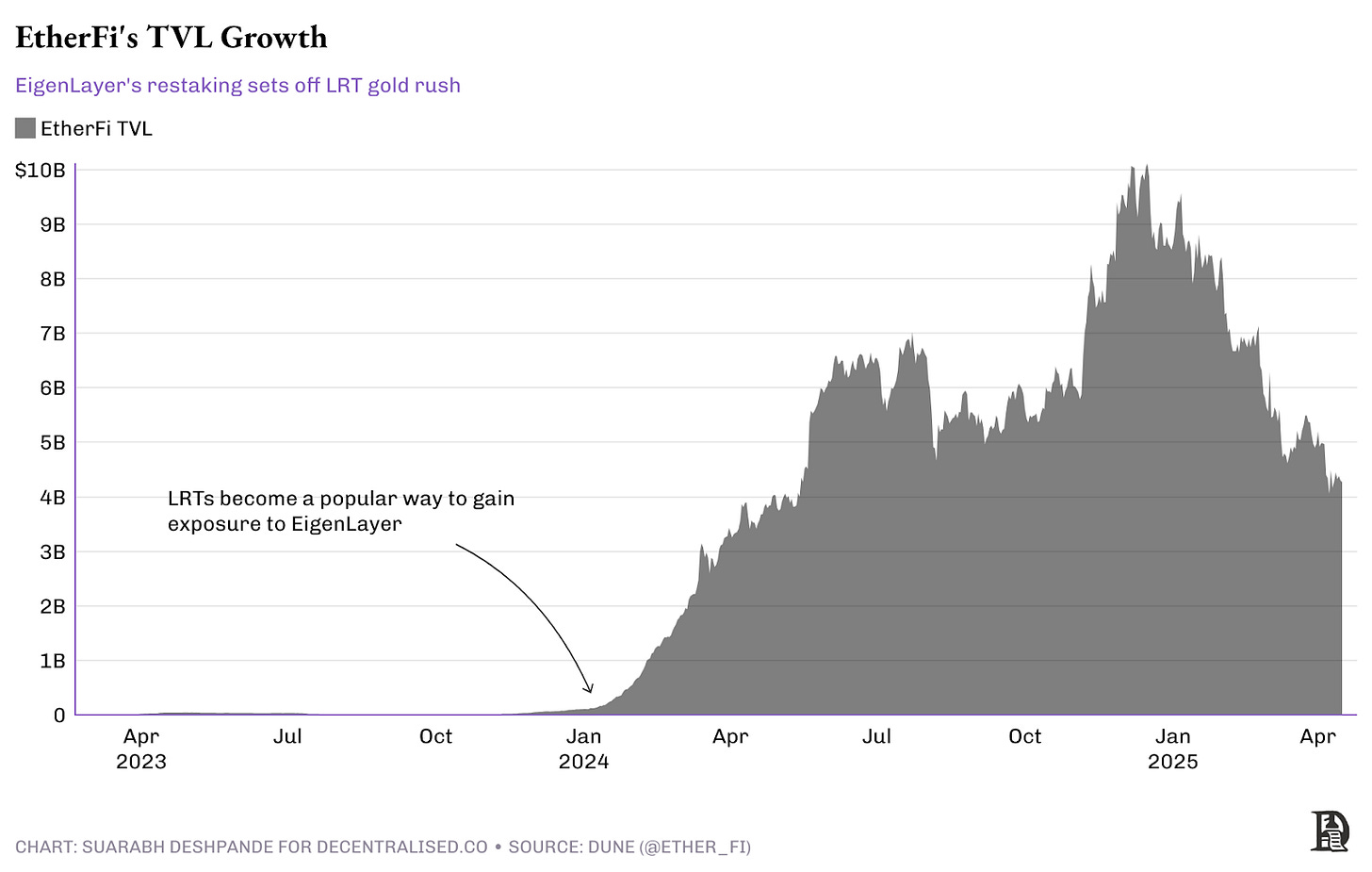

The interesting part isn’t just that EigenLayer made restaking a thing. It’s what everyone else did next. EtherFi, a liquid staking provider that had quietly launched earlier in 2023.

Ether.fi anticipated that EigenLayer’s restaking would be one of the most sought-after opportunities in DeFi. You stake ETH, get your eETH tokens, and then automatically restake on EigenLayer. And, as a bonus, you can then take eETH and go play in other DeFi sandboxes. Pendle was one such sandbox. It’s like getting paid multiple times for doing essentially the same thing—crypto finance, everybody.

The results? Pretty impressive. Ether.fi’s total value locked (TVL) rocketed to around $6 billion by May 2024. Their “Liquid Vault” was offering something like 10% APY at a time when plain-old staking wasn’t nearly as exciting.

Ether.fi effectively did for restaked ETH what Lido had previously done for staked ETH. By creating liquidity, accessibility, and usability around restaked ETH, they made restaking practical, mainstream, and profitable.

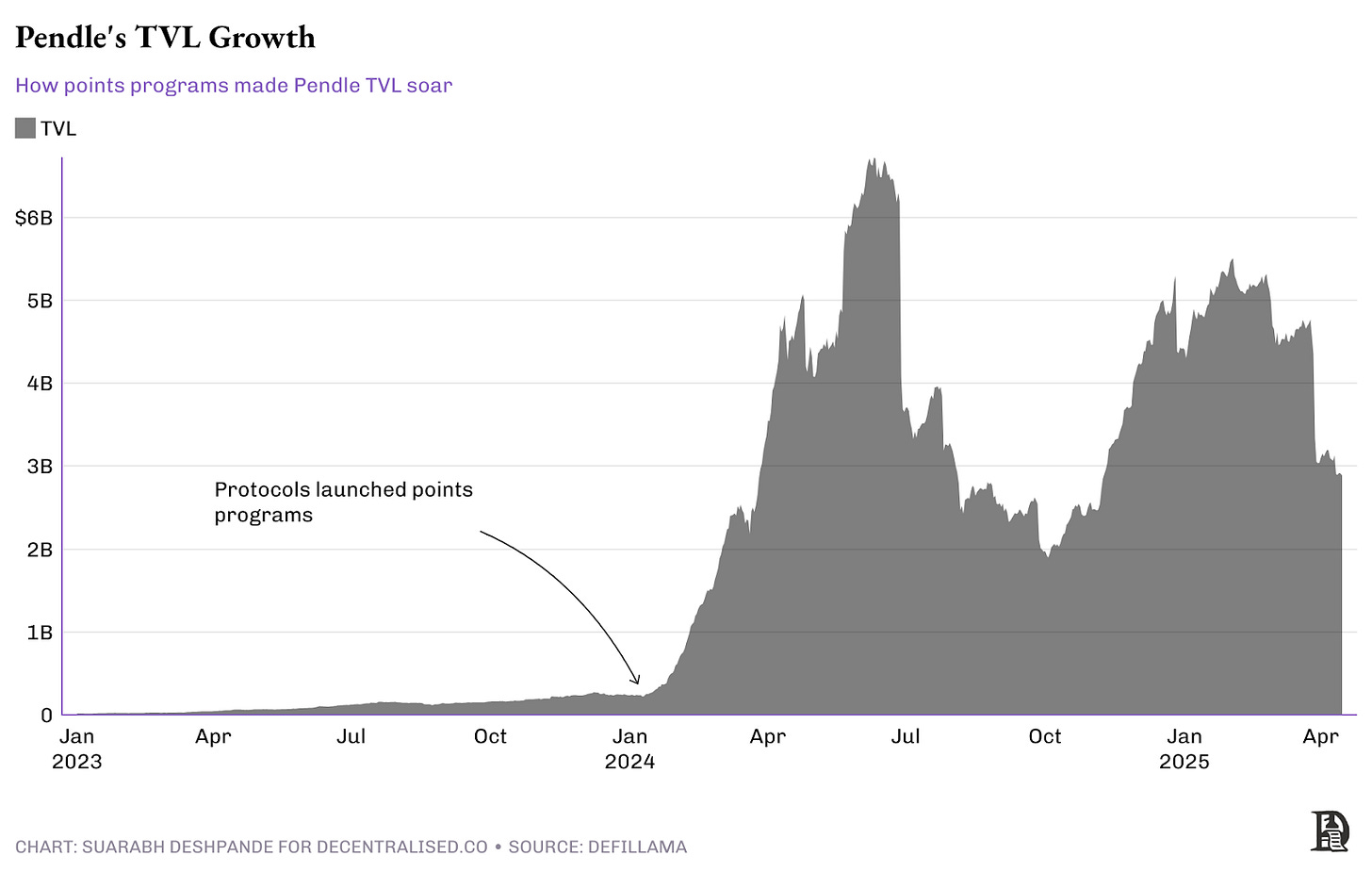

But wait, there’s more. On top of all this yield chasing, we had “points farming,” where people weren’t just after immediate yield but accumulating “points” that might someday turn into valuable tokens. A speculative flywheel, if you will. As more users restaked through Ether.fi, more eETH tokens circulated, integrating deeply into other DeFi projects like Pendle, where you could trade future yield and even points themselves, creating entirely new financial instruments out of thin air.

A side note on what happened to points — Crypto, after all, is the land of efficient capital mercenaries. The moment protocols started dangling points as rewards, armies of users showed up to maximise them, heavily gaming the system in the process. The original intent behind points was to enable fairer, broader token distribution. But once it became a race, the results skewed. The most active farmers weren’t always the most aligned users. While many projects still use points to distribute tokens, the strategy doesn’t command the same mindshare it once did.

So the lesson, as usual, isn’t just that innovation matters. It’s more so that the big winners often aren’t the ones who build the thing everyone talks about at first. They’re the ones who show up later, see what’s really happening, and build exactly the right thing at exactly the right time.

EigenLayer set the stage, sure, but Ether.fi and the others who saw the second-order effects captured a slice of the pie, eventually snagging over 20% of Ethereum’s staking market by mid-2024. In crypto, being first matters less than being best at understanding what everyone else is doing.

Points and Pendle

Points became a meta in December 2023 after Jito’s massively successful airdrop. This Solana-based protocol debuted with over a billion dollars of FDV, setting off a gold rush. Suddenly, protocols across the ecosystem shifted away from direct token distribution in favour of point systems. They started rewarding users with points for protocol engagement that could later be redeemed for governance tokens. What began as a new distribution mechanism quickly evolved into the dominant strategy for bootstrapping protocol usage across DeFi.

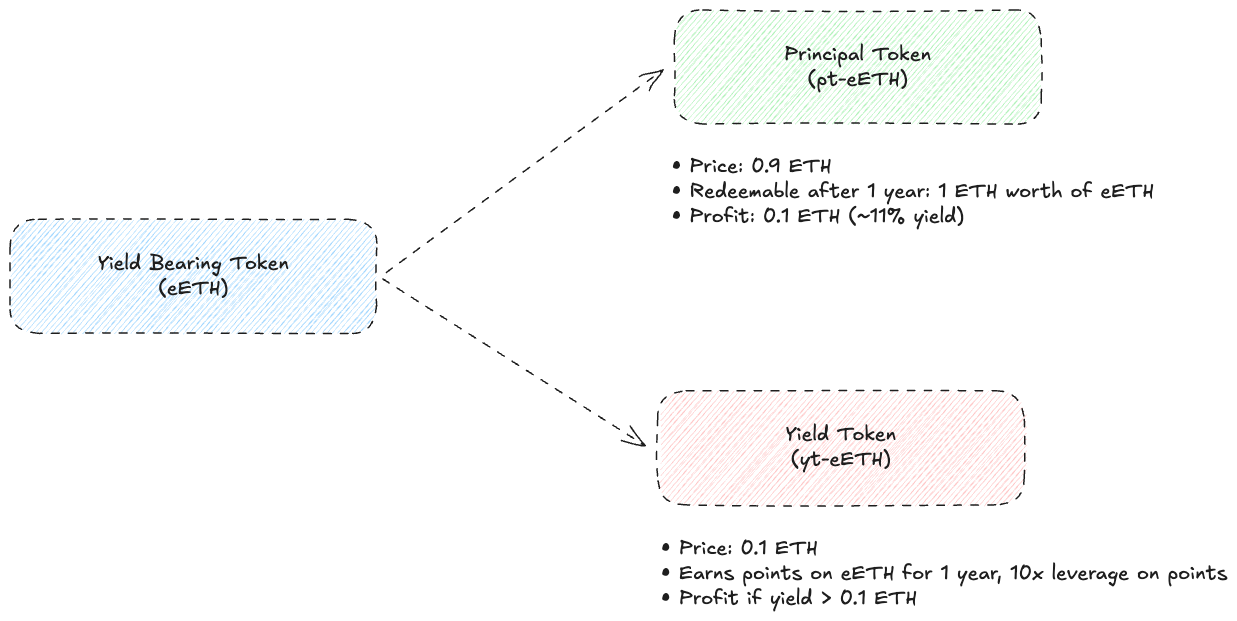

Pendle launched in June 2021. It specialises in tokenising and trading future yield. Pendle’s core innovation was elegant because it splits yield-bearing tokens into two components. Principal Token (PT) that represented the underlying asset, and Yield Tokens (YT) capturing the future yield. This separation allowed users to trade these components individually, giving them greater control over their yield strategies than before.

When the points race began in earnest, Pendle found itself perfectly positioned through a feature it had built for entirely different reasons. The platform’s YT tokens created a mechanism for what amounted to leveraged points farming. Users could gain exposure to an asset’s floating yield and any associated points simultaneously, amplifying their point accumulation without requiring additional capital.

Here’s how it worked in practice. Imagine Sid wants to earn points from a protocol like EigenLayer that rewards liquidity providers. Traditionally, he’d need to deposit ETH into EigenLayer’s staking contract and lock that capital for weeks or months. With the combination of liquid restaking tokens (LRTs) and Pendle, Sid could instead buy Yield Tokens (YT) representing future yield and points instead of depositing ETH directly into EigenLayer.

For example, let’s say eETH costs $2000 and gives you exposure to 24 EigenLayer points per day. pteETH represents the fixed yield token, and yteETH represents the floating yield and costs $200. pteETH holders forgo points for a fixed yield. yteETH holders get floating yield and points. Now, for $2000, Sid gets exposure to 240 (10 ETH worth) points per day instead of just 24.

TN Lee, Pendle’s founder, broke this down on my podcast. The team hadn’t built for the points meta. They couldn’t have predicted it. But they had built the perfect infrastructure for an emergent behaviour, and they capitalised magnificently. Even when the trend eventually cooled and TVL dropped to ~$2.5 billion, they still managed an impressive 10-15x from their pre-points-meta levels.

Memecoins, Pump.fun, and Raydium

Sometimes, second-order effects emerge from the most unexpected places and resurrect entire ecosystems in the process. The Solana revival story of 2023-2024 provides a brilliant case study in how quickly fortunes can change in crypto, and how value accrues to those who position themselves at crucial intersections.

After FTX’s spectacular collapse in late 2022, many industry observers had written Solana’s obituary. The logic seemed sound. Sam Bankman-Fried and his companies had wielded enormous influence over the ecosystem, providing funding, liquidity, and market support. Without them, Solana was visibly struggling. The technology was plagued with reliability issues, with “Solana Outage” headlines becoming a running joke in crypto media. The chain that once positioned itself as the “Ethereum killer” seemed to be on life support.

Yet beneath the surface, a remarkable change was underway. Throughout 2023, Solana’s technology steadily improved. Outages became increasingly rare. Transaction finality and user experience became noticeably smoother. Developers who had been attracted to Solana’s technical fundamentals, like high throughput, low costs, and sub-second finality, began returning, albeit cautiously.

By early 2024, the tide had decisively turned. As disillusionment with traditional DeFi governance tokens grew amid a broader shift toward what some called “financial nihilism,” user attention and capital began channelling into memecoins. These tokens, often launched with little utility beyond community ownership and cultural signalling, captured the market’s imagination. And Solana, with its lightning-fast transactions and negligible fees, proved the perfect environment for this new wave.

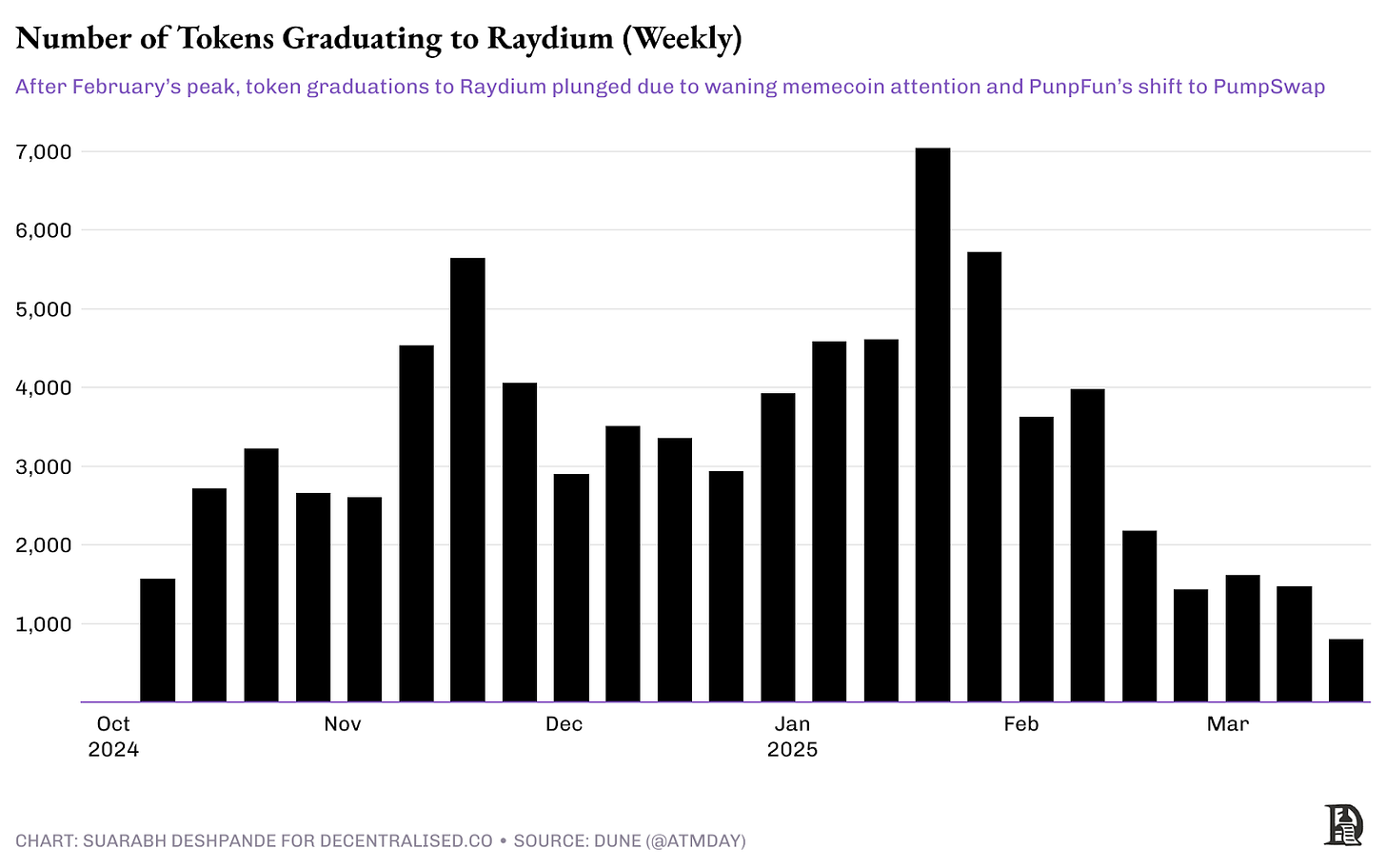

PumpFun launched in January 2024. This “memecoin factory” reduced the token creation process, once the domain of developers with coding skills, to a simple form that could be completed in mere minutes. PumpFun democratised token creation in a way that resonated perfectly with crypto’s ethos of financial experimentation. Almost overnight, thousands of new tokens with names like “BONK,” “Dogwifhat,” and “POPCAT” flooded the Solana ecosystem.

What seemed like crypto frivolity quickly revealed itself as the catalyst for a sophisticated value chain. These new tokens needed something essential: Liquidity. Without places to trade them, even the cleverest memecoin concept would remain worthless. This is where Raydium, Solana’s leading decentralised exchange, found itself in an enviable position.

Raydium had built itself to be Solana’s trading backbone since its inception, with a focus on capital efficiency and low slippage. The protocol wasn’t designed specifically for memecoins. But its technical architecture, similar to Uniswap’s concentrated liquidity pools and permissionless token listing process, proved perfectly suited for the sudden influx of new assets.

The timing couldn’t have been more fortuitous. Years of infrastructure development had created the exact foundation needed for this unexpected use case.

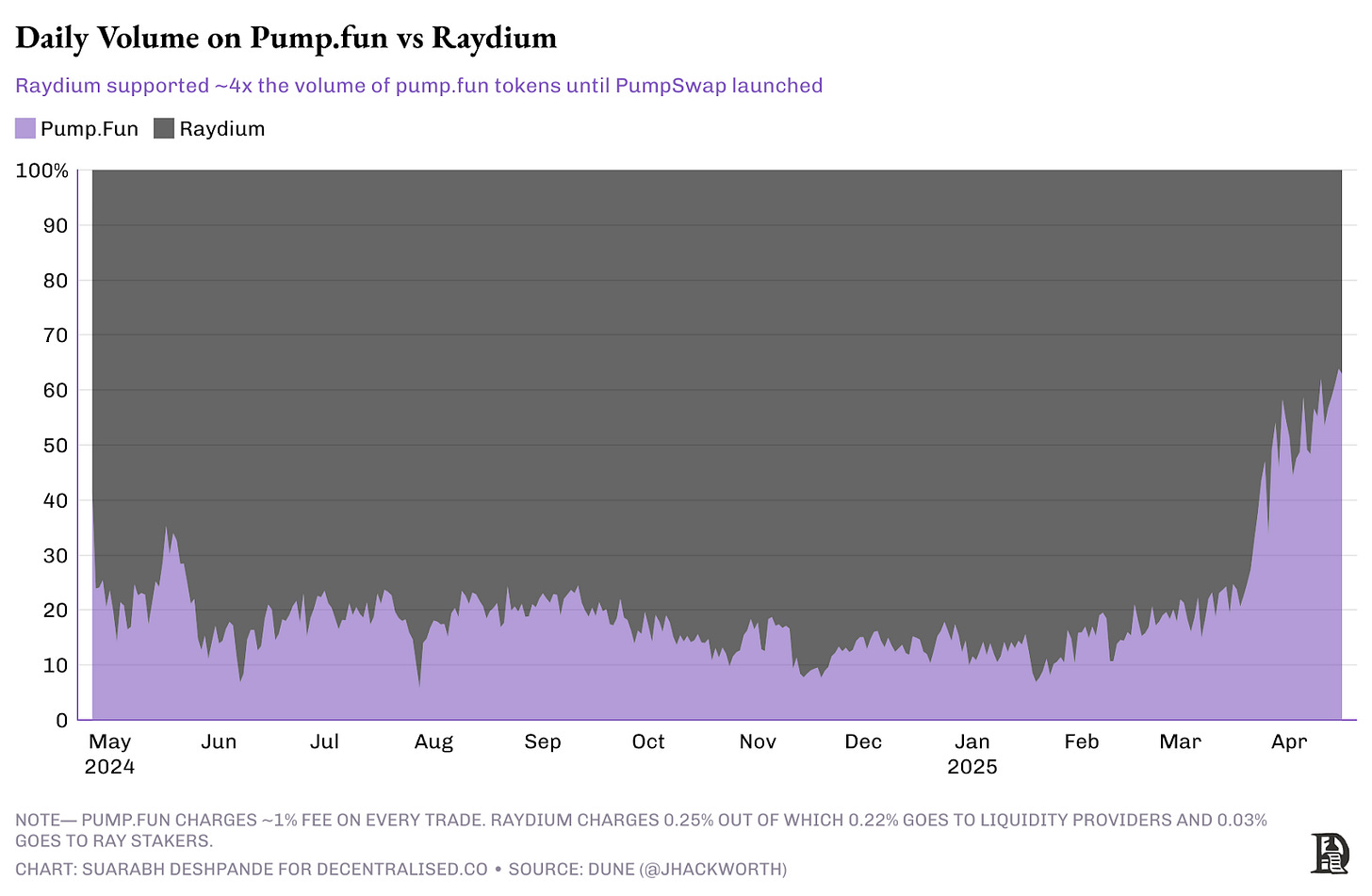

Graduating to a Raydium listing became an important milestone for these nascent tokens, providing both credibility and visibility in an increasingly crowded space. By early 2025, this symbiotic relationship had become so significant that more than 40% of Raydium’s swap revenue derived from PumpFun-generated tokens.

The relationship was mutually beneficial: PumpFun needed Raydium’s established liquidity pools to elevate their tokens from niche curiosities to tradable assets, while Raydium thrived on the explosive trading volumes these tokens generated.

This prosperity wasn’t lost on PumpFun’s team. The economics were compelling: tokens traded exclusively on PumpFun’s platform incurred a 1% fee per transaction, compared to Raydium’s 0.25% fee structure. This meant Raydium needed to generate four times the trading volume to match PumpFun’s revenue per token. It consistently managed to exceed this threshold between August 2024 and February 2025 due to its deeper liquidity and wider user base.

Raydium hadn’t created the memecoin primitive, nor had they originated the easy-to-use token factory concept. Yet by providing robust infrastructure for trading these assets and quickly adapting to competitive threats, they captured a massive portion of the value flowing through the ecosystem.

The Solana memecoin saga illustrates a crucial aspect of second-order effects: value often accrues not to those who create new behaviours, but to those who facilitate them at scale. PumpFun simplified token creation, but Raydium enabled efficient price discovery and trading. Each innovation triggered further adaptations. PumpFun’s movement toward vertical integration spurred Raydium’s creation of LaunchLab, creating a cascade of second-order effects that reshaped the entire ecosystem.

This attention didn’t just revive an ecosystem. It was actively harvested. As the memecoin frenzy gained momentum, coins like Trump (launched by the US President before assuming office) and Libra (speculated involvement of Argentina’s President Javier Milei) were probably launched with the explicit goal of surfing the wave. Their playbook relied on narrative, timing, and cultural virality. Trump rode on political meme energy, while Libra leaned into broader internet culture. Both coins saw massive initial traction, and trading at absurd valuations shortly after launch.

But the energy didn’t last. As fast as the attention came, it drifted. Secondary markets cooled. Traders moved on. Communities thinned out. What these coins did well was demonstrate how attention, when captured at the right moment, can be converted into speculative gold. What they failed to do, however, was sustain it. There was no real utility, no evolving roadmap, just a moment in time.

Still, they proved a point. Innovation attracts attention. And attention, in crypto, is one of the most powerful raw materials you can work with. Used well, it can spark new movements. Used poorly, it burns out fast.

For observers of crypto innovation, the lesson is clear. When new primitives emerge, look not just at their direct impact but at who is best positioned to facilitate, optimise, and scale the behaviours they enable. That’s where the truly outsized returns often materialise.

What now?

If you’ve made it this far, you’re probably wondering what the next second-order explosion looks like. Maybe you call it compounding innovation, maybe it’s technological convergence, maybe it’s just crypto being crypto, but the point is the same. We’re talking about multiple technologies clicking into place at the same time, setting off a chain reaction that’s bigger than the sum of its parts.

We’ve already seen it happen: restaking reshaped DeFi incentives, memecoin infrastructure revived entire ecosystems, and yield protocols accidentally enabled airdrop leverage. So, what is the next domino? Maybe it’s the EVM experience. Maybe. It’s indeed being rewritten, reworked, and polished to feel like real software—or at least that’s the promise. Whether it becomes the next great layer of compounding or just another incremental upgrade remains to be seen.

But if the pieces click into place, it could spark a chain reaction we’ve never quite seen before.

Beneath the noise of L2 debates and scaling wars, there’s a race brewing—not just to scale Ethereum, but to compound its utility by making it usable. Really usable. A foundation others can build on without tripping over wallets, gas, or failed transactions. Because when friction disappears, experimentation flourishes. And when experimentation flourishes, compounding returns start to appear in the most unexpected places.

Over the last few months, I’ve hosted some of the folks leading this charge: Andre Cronje from Sonic, Keone Hon from Monad, and Shuyao Kong, better known as Brother Bing, from MegaETH. And while their approaches differ, the ambition is loud and clear: Kill latency. Kill friction. Kill wallets, even. Replace them with something faster, smoother, invisible. Real software experiences, not click-through rituals.

MegaETH and Monad both claim they’ll crack 10,000 transactions per second. That’s Solana-speed, but with Ethereum semantics. Knowing fully that crypto has a tendency to overpromise and underdeliver, if it happens, it would be the first time an EVM-based chain puts Solana on the defensive in the UX arena. (This is kind of hilarious, considering how long EVM chains have settled for sluggish confirmations and wallet pop-ups from hell.)

Andre’s pitch is less about raw speed and more about melting away complexity. He says Ethereum isn’t even close to its performance ceiling. According to him, it’s humming along at maybe 2% of capacity. Not because of hardware limits, but because of how the EVM accesses and writes data. Sonic has already reduced the data storage requirement by 98% with its new database structure! His Sonic roadmap is a bet on abstraction— abstract gas, abstract accounts, abstract wallets. By the year’s end, if all goes according to plan, users won’t even know they’re on a blockchain while maintaining a decent degree of decentralisation. And that’s precisely the point.

So, who wins in this brave new world? It’s probably not the infra teams racking up TPS benchmarks but the apps that build on top, like how Pumpfun used Solana infrastructure and raked in half a billion dollars in less than a year. Social protocols, especially, could break through. The likes of Farcaster already show what’s possible when you blend crypto’s permanence with web-native ease. No more paying to post. No more MetaMask popups. Just content, shared.

And then there’s DeFi. The next generation of financial apps needs better inputs. Andre put it bluntly: “We don’t have on-chain volatility, implied volatility, or realised volatility.” Until we do, we’re playing with training wheels. But when the data catches up, expect actual options markets, coherent derivatives, and properly structured perpetuals—the financial layer that crypto keeps pretending it already has.

And maybe the most exciting are the apps we haven’t even imagined yet. Because that’s how it always goes. Nobody looked at Google Maps in 2005 and said, “You know what this needs? Ride-sharing.” But when the foundation shifts, everything above it moves too.

So, yes, I’m sceptical. I’ve been in crypto long enough to know that every promised 10x improvement usually gets you a slightly better dashboard and a lot more Discord notifications. But I’m also excited. Because this time, the primitives feel real. And behind them, there’s a whole new generation of builders quietly working on the second-order magic that just might reshape everything. Because for every breakthrough primitive we see today, dozens of builders are already working on the second-order applications that will bring that primitive’s true value to light.

如何安全优惠折扣参与交易比特币?老用户也可以

- 币圈交易所注册,享终生全网最高手续费返佣减免!同时新用户还可额外获600U手续费抵扣券,币圈老用户点链接可重新获手续费减免回归礼,节省交易大量手续费

- Bitget优惠返佣注册👉: https://my5353.com/Bitgetapp

- binance币安优惠返佣注册👉:https://my5353.com/binance66

- OKX优惠返佣注册👉:https://my5353.com/okx66

- 遇到困难参考教程:

- www.btcwbo.com/index.php/2025/04/08/bitget/

**本文仅代表原作者观点,不构成任何投资意见或建议。

-END-

【发布或转载文章仅为区块链传播更有价值的信息,文章版权归原作者所有,其内容与观点不代表本站立场。本站咨询均为网站收集而来,版权归版权所有人所有,若版权者认为其作品不宜供传播或不应无偿使用,请联系我们,本站将立即更正。

No Comments